/

Crypto/

Tether Plans $1 Billion Investment in Emerging Markets, AI, and Biotechnology for 2024

Crypto

2024-06-13

Tether, the world’s largest stablecoin issuer, plans to invest over $1 billion in emerging markets, AI, and biotechnology in the next 12 months. With significant profits and diversified investments, Tether continues to lead in financial innovation and stability.

Tether, the world's largest stablecoin issuer, alongside its investment firm Tether Investments, has announced plans to invest over $1 billion in various opportunities over the next 12 months.

Tether CEO Paolo Ardoino shared these plans in an interview with Bloomberg, revealing the company's focus on alternative financial infrastructure for emerging markets, artificial intelligence (AI), and biotechnology. In the past two years, Tether has already invested approximately $2 billion in AI and biotechnology.

Diversification is key to Tether's strategy, with significant investments in the biotech sector. The company has notably backed Blackrock Neurotech, which specializes in brain-computer interface technology.

Ardoino emphasized Tether's commitment to biotech, particularly as other major players reduce their involvement.

"It's all about investing in technology that helps with disintermediation of traditional finance," Ardoino stated, highlighting the goal of reducing reliance on tech giants like Google, Amazon, and Microsoft.

In the interview, Ardoino mentioned that Tether plans to allocate a substantial portion of its profits to these investment opportunities.

The company is attracting numerous potential investments, with dozens or even hundreds of proposals each month. However, the selection process is rigorous, with only a small percentage of opportunities being accepted.

Tether's attestation for the first quarter of 2024 revealed a net profit of $4.52 billion, marking a record in financial performance. The firm reported its highest-ever percentage ownership of Treasury bills and total net equity exceeding $11.3 billion.

Tether Holdings Limited's assurance opinion for Q1 2024 detailed $1 billion in profit from its stablecoin issuance and reserve management. Most of this profit came from U.S. Treasury holdings, with additional gains from bitcoin and gold positions.

"Tether continues to shatter records with a new profit benchmark of $4.52 billion, reflecting the company’s sheer financial strength and stability.

In reporting not just the composition of our reserves, but now the group’s net equity of $11.37 billion, Tether is again raising the bar in the cryptocurrency industry in terms of transparency and trust," Ardoino stated in the May 1st announcement.

Wanna Stay on top of the Game? Join our free Newsletter

Australian Open 2026 Preview: Record Prize Money and Historic Stakes in Melbourne

Best Christmas Slots 2025 | Festive Casino Games on tether.bet

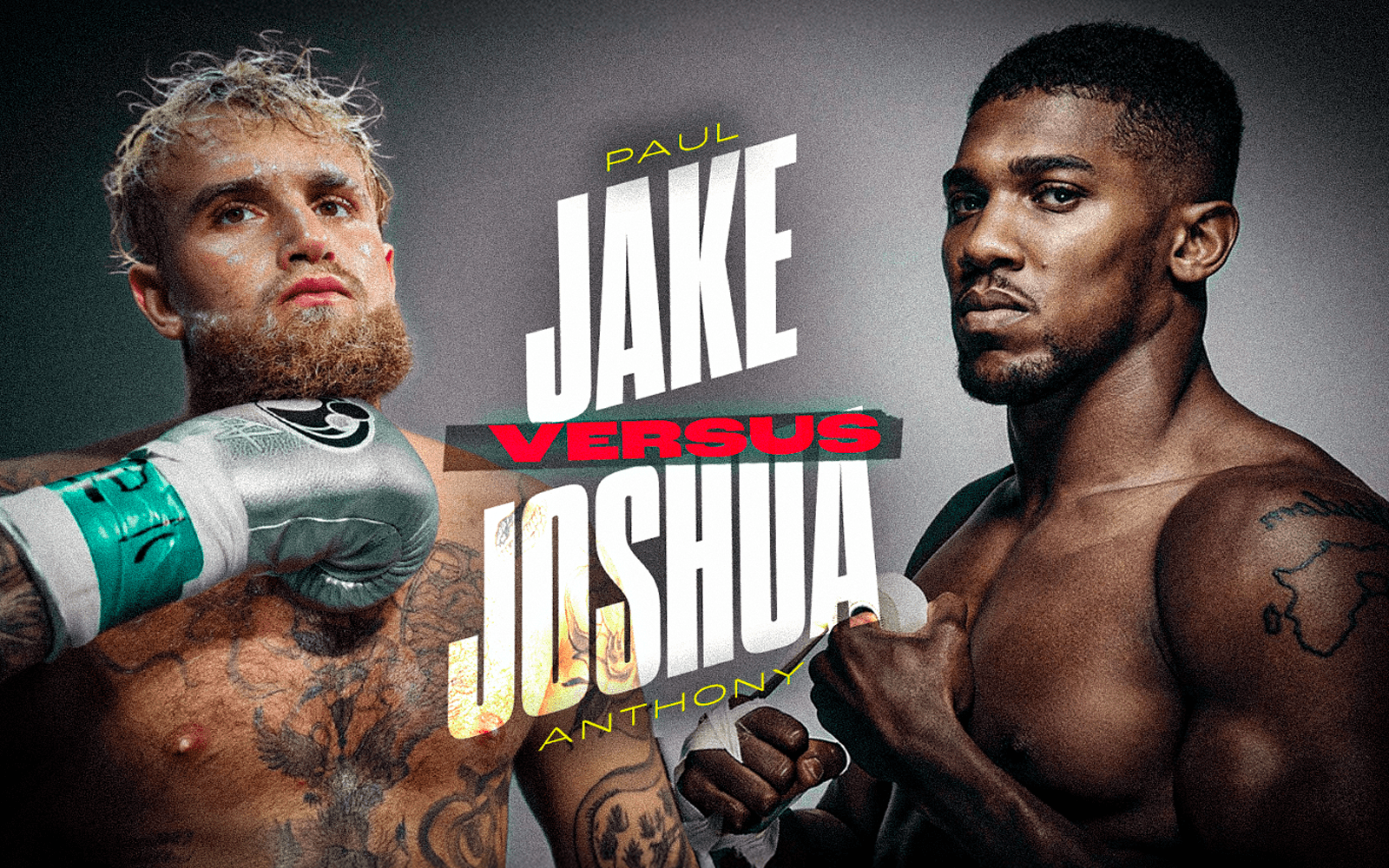

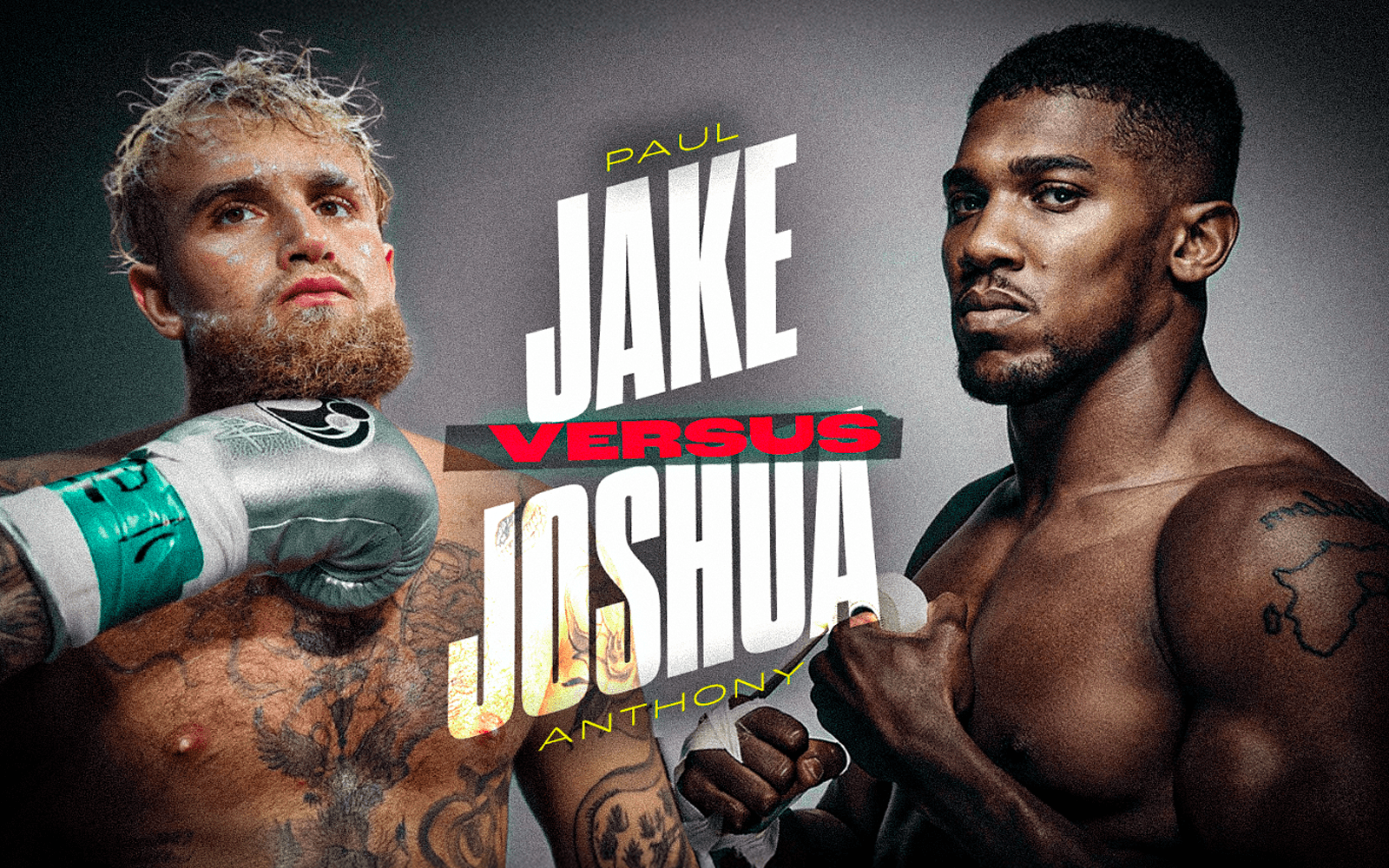

Jake Paul vs Anthony Joshua Preview: Spectacle, Money and a Heavyweight Clash

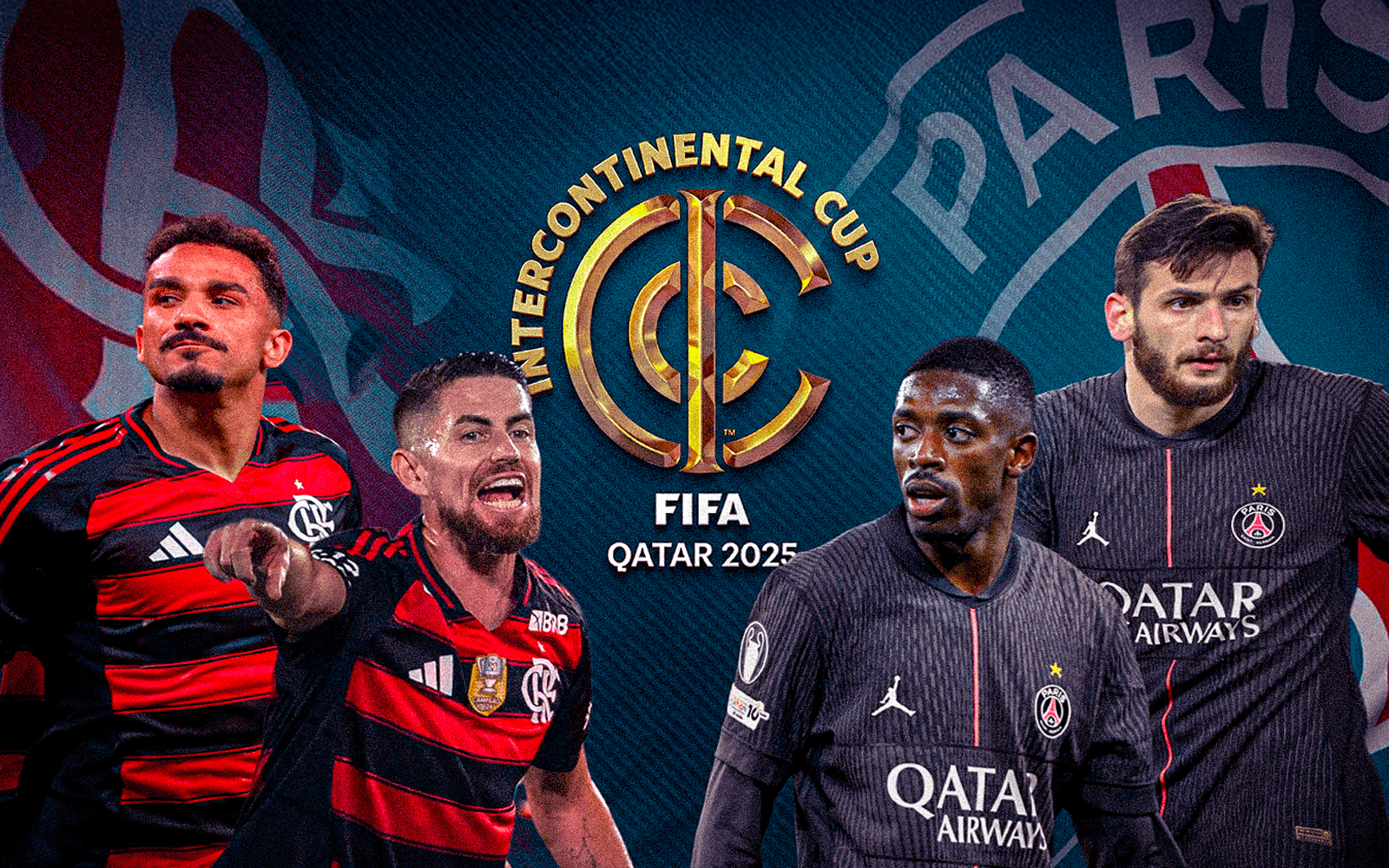

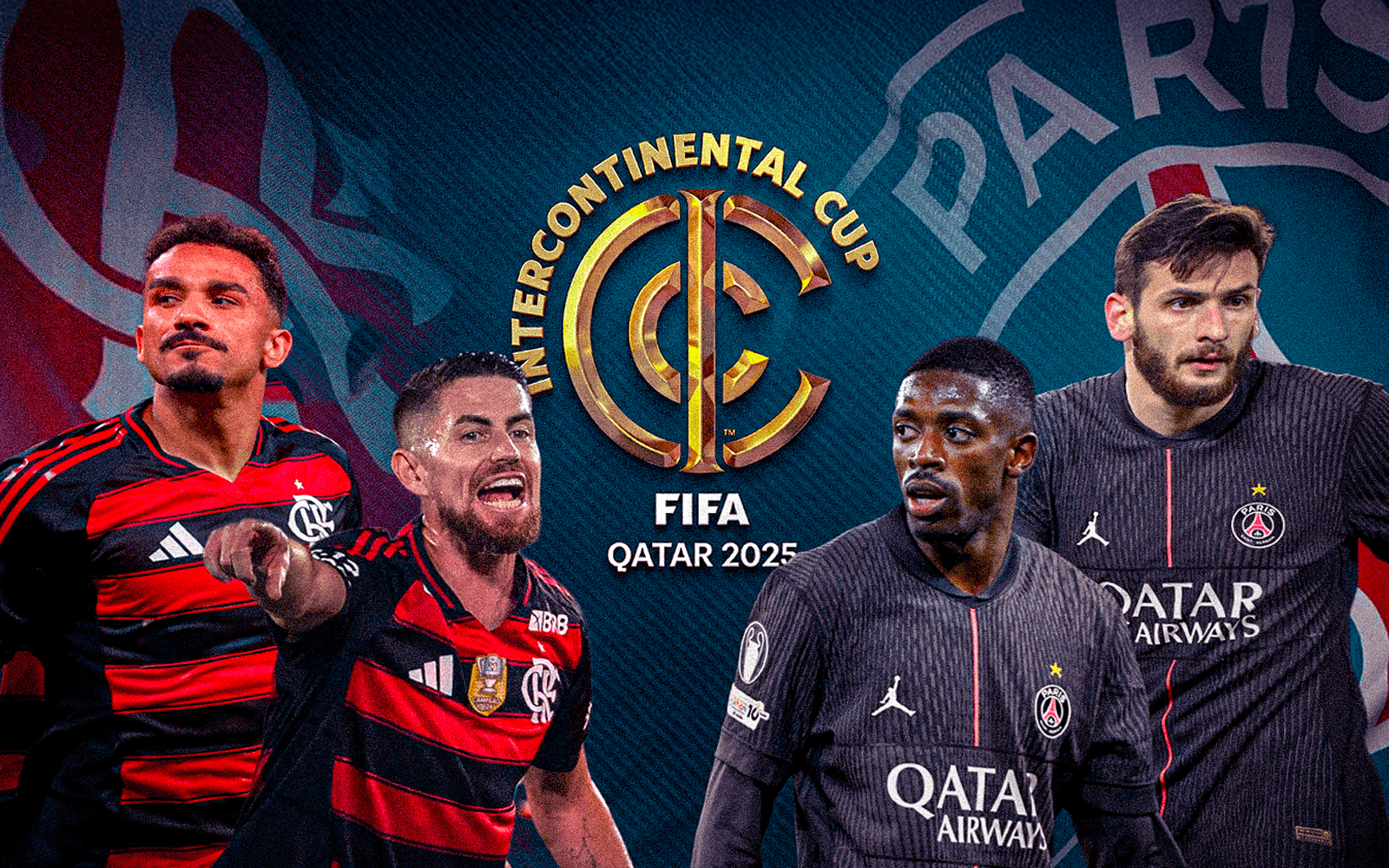

PSG vs Flamengo Intercontinental Cup Final Preview & Betting Tips

Best Crypto Betting Platforms in India | USDT & BTC Sportsbooks

Wanna Stay on top of the Game? Join our free Newsletter

Australian Open 2026 Preview: Record Prize Money and Historic Stakes in Melbourne

Best Christmas Slots 2025 | Festive Casino Games on tether.bet

Jake Paul vs Anthony Joshua Preview: Spectacle, Money and a Heavyweight Clash

PSG vs Flamengo Intercontinental Cup Final Preview & Betting Tips

Best Crypto Betting Platforms in India | USDT & BTC Sportsbooks

More Articles

Sports

2025-08-26

EuroBasket 2025 tips off! Explore groups, key players, tournament format and betting odds with tether.bet’s exclusive Free Bet promo.

Casino

2025-11-13

Discover the most popular Endorphina slots of 2025 and join the Fall Fortune Multiplier promotion with a €5,000 prize pool. Play top Endorphina titles on tether.bet.

Casino

2025-07-21

Discover the best Hacksaw Gaming slots with top features and big win potential. Play the most popular titles and explore unique slot mechanics.

Wanna Stay on top of the Game? Join our free Newsletter

Info

Help

Responsable Gambling

© 2024 tether.bet | All rights reserved.