Crypto

2024-12-12

Tether, the largest company in the digital asset industry, has announced that USDT has been accepted by the Financial Services Regulatory Authority (FSRA) as an Accepted Virtual Asset (AVA) in the Abu Dhabi Global Market (ADGM).

"This approval enables FSRA-licensed Authorized Persons to offer pre-approved USDT-related services, further cementing the region's leadership position in digital asset innovation. The announcement comes at a growing acceptance of digital currencies in the United Arab Emirates (UAE), reflecting the nation's proactive approach to integrating traditional and digital finance", stated Tether in their announcement.

The UAE, whose dirham is pegged to the US dollar, represents the global standard of economic stability. Tether's USDT, which now exceeds a market cap of $138 billion as the world's most used stablecoin, with over 400 million users worldwide, contributes to that stability by providing a reliable and efficient link between traditional fiat systems and digital economies.

As of 2022, cryptocurrency adoption in the UAE has grown significantly. This progressive regulatory framework has positioned cities like Abu Dhabi and Dubai as global leaders in cryptocurrency and blockchain technology innovation, creating a prosperous ecosystem for digital assets.

“This step confirms Tether's commitment to global financial inclusion and innovation. By bringing USDT to the forefront of ADGM's regulated virtual framework, we confirm the importance of stable tokens as key tools for the modern financial industry and open up new opportunities for collaboration and growth across the Middle East," said Paolo Ardoino, CEO of Tether.

Ardoino proudly announced that Tether plays a key role in advancing economic development, emphasizing its security, trust, and efficiency as pivotal aspects.

"The UAE's progressive approach to virtual asset regulation sets a global standard, and we are proud that USD₮ can play a key role in advancing economic development and digital transformation in the region. This approval underscores Tether's commitment to building bridges between traditional and decentralized economies while ensuring security, trust and efficiency for users worldwide.”

ADGM's recognition of USDT as an Accepted Virtual Asset represents a key moment in the evolution of virtual assets in the region.

This approval ensures that USDT meets the standards set by ADGM, enabling the seamless integration of USDT into the approved services of licensed entities in ADGM and supporting the diversification and modernization of the UAE financial landscape.

ADGM's decision reflects the increasing role of stable tokens in bridging the gap between traditional finance and digital asset markets.

By integrating USDT into its framework, ADGM can further strengthen its position as a financial centre for innovation and support its economic diversification in the UAE.

Tether, one of the most traded cryptocurrencies, offers several advantages in the online betting sector. Tether’s stable 1:1 exchange rate with the US dollar ensures that users experience minimal fluctuation when withdrawing their winnings from betting platforms.

Tether continues to expand. In June, the company announced a staggering $1 billion investment plan over the next 12 months.

Tether CEO Paolo Ardoino shared these plans in an interview with Bloomberg, highlighting the company's focus on alternative financial infrastructure for emerging markets, artificial intelligence (AI), and biotechnology.

Over the past two years, Tether has invested approximately $2 billion in AI and biotechnology.

Additionally, the company has hired Jesse Spira, PayPal’s former Head of Regulatory Relations, further demonstrating Tether’s commitment to long-term stability and regulatory compliance.

Stablecoins like Tether are pegged to real-world currencies (fiat), such as the US dollar or euro. They offer numerous benefits to crypto trading by providing liquidity and protection from the volatility of the cryptocurrency market.

While cryptocurrencies like Bitcoin and Ethereum allow users to bypass traditional payment intermediaries, their prices are notoriously unpredictable, often fluctuating dramatically in short periods.

Stablecoins like Tether do not experience such volatility. Instead, they remain closely aligned with the value of the fiat currency they are pegged to, making them a safe haven in the world of cryptocurrency.

Wanna Stay on top of the Game? Join our free Newsletter

Australian Open 2026 Preview: Record Prize Money and Historic Stakes in Melbourne

Best Christmas Slots 2025 | Festive Casino Games on tether.bet

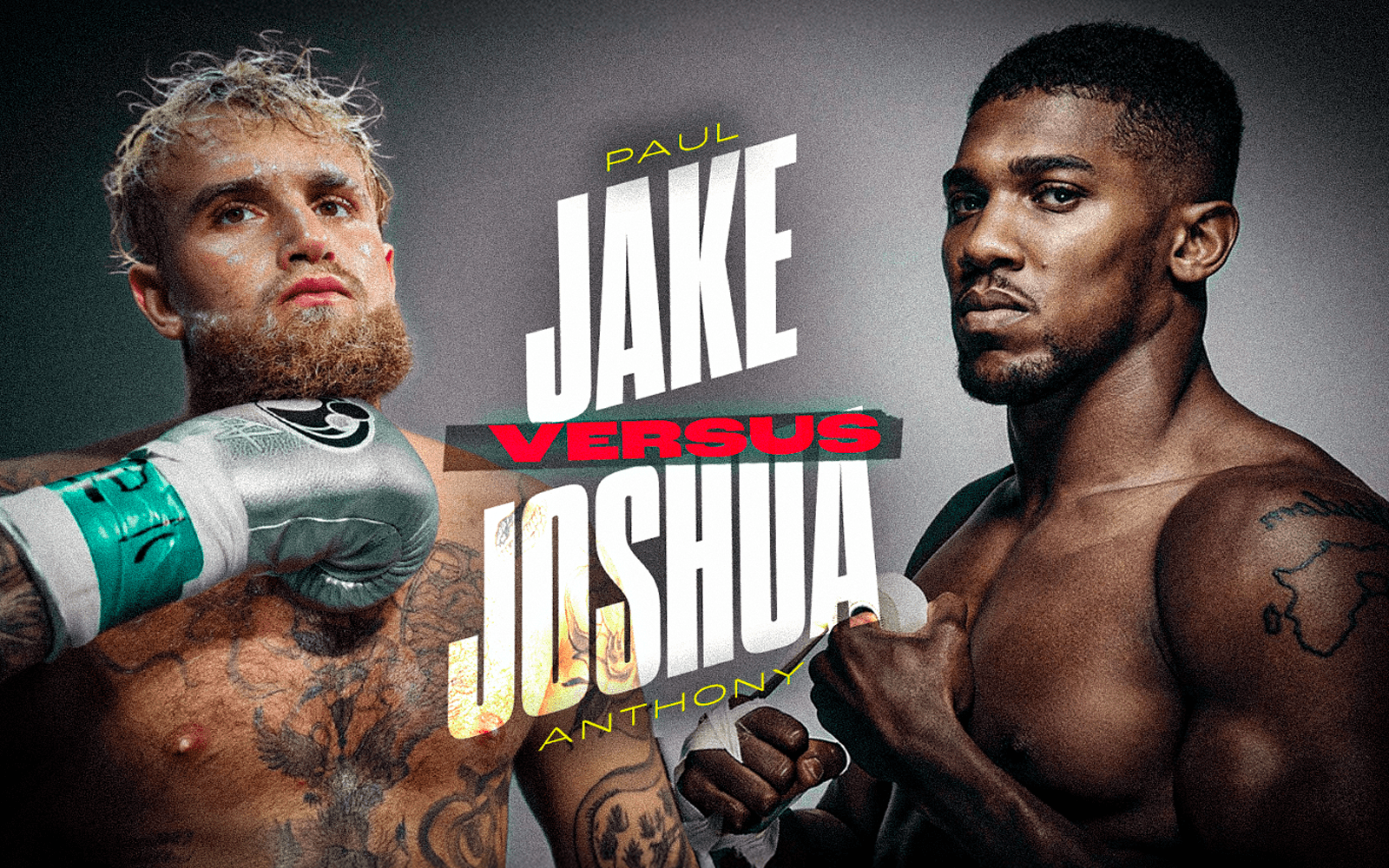

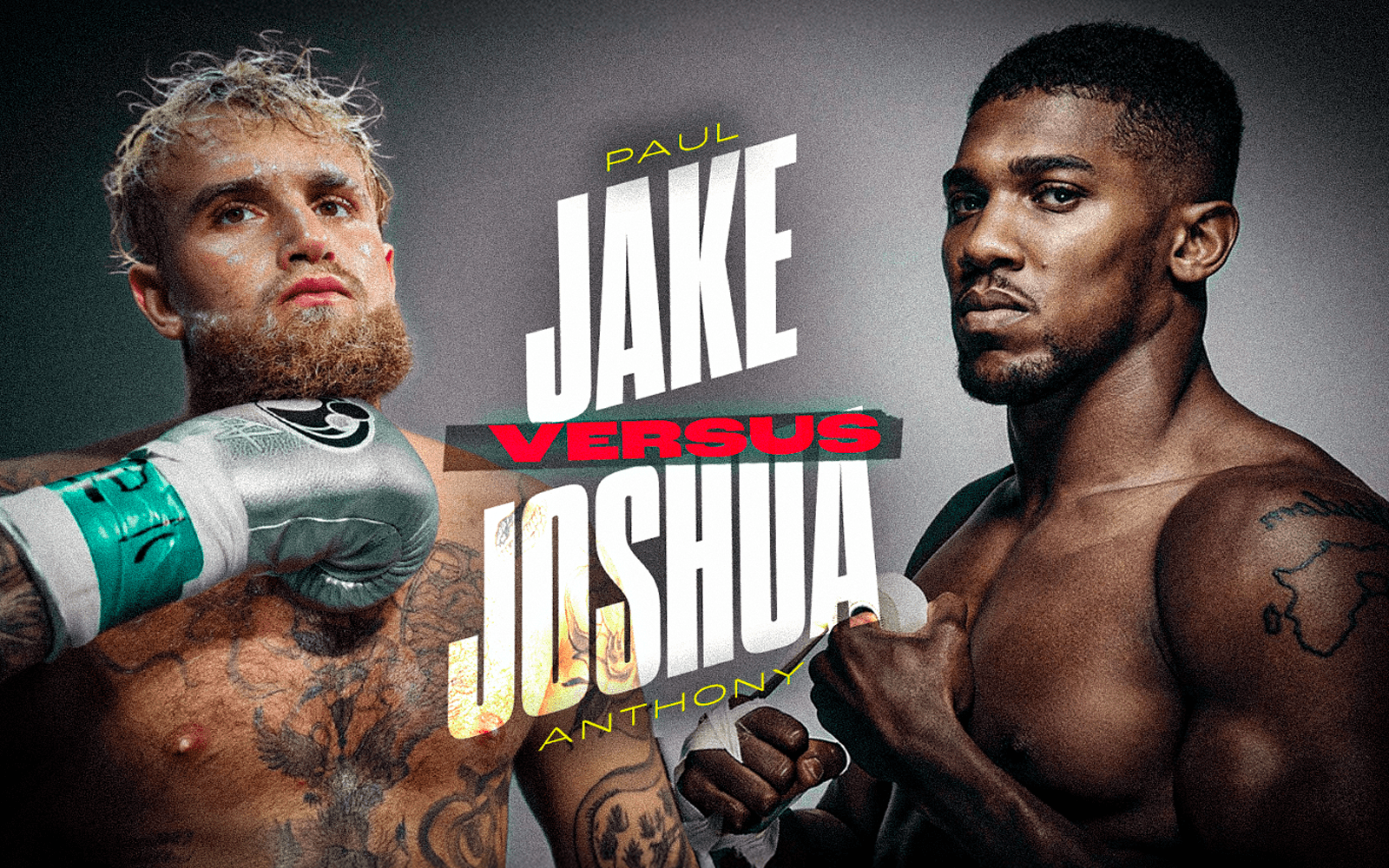

Jake Paul vs Anthony Joshua Preview: Spectacle, Money and a Heavyweight Clash

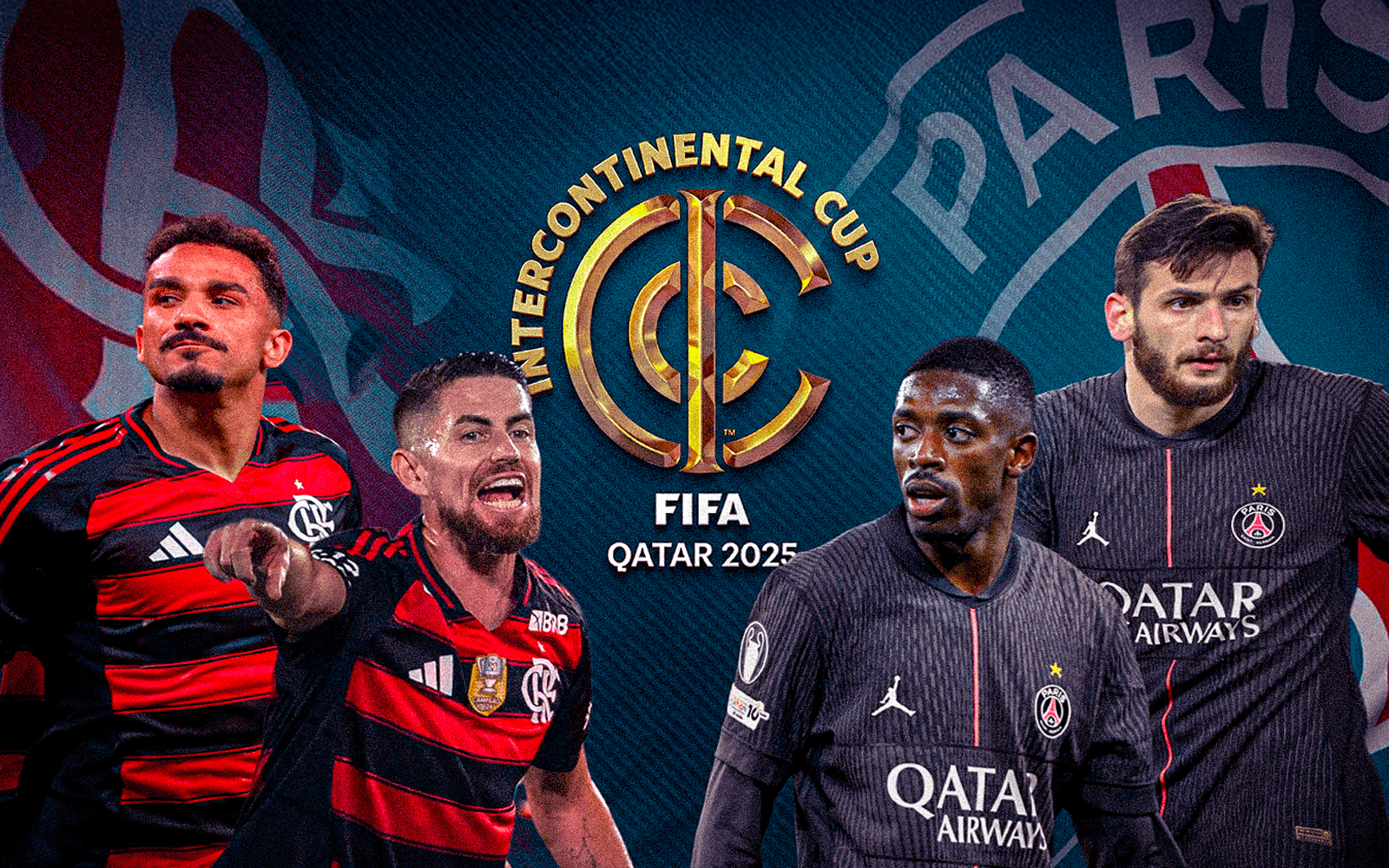

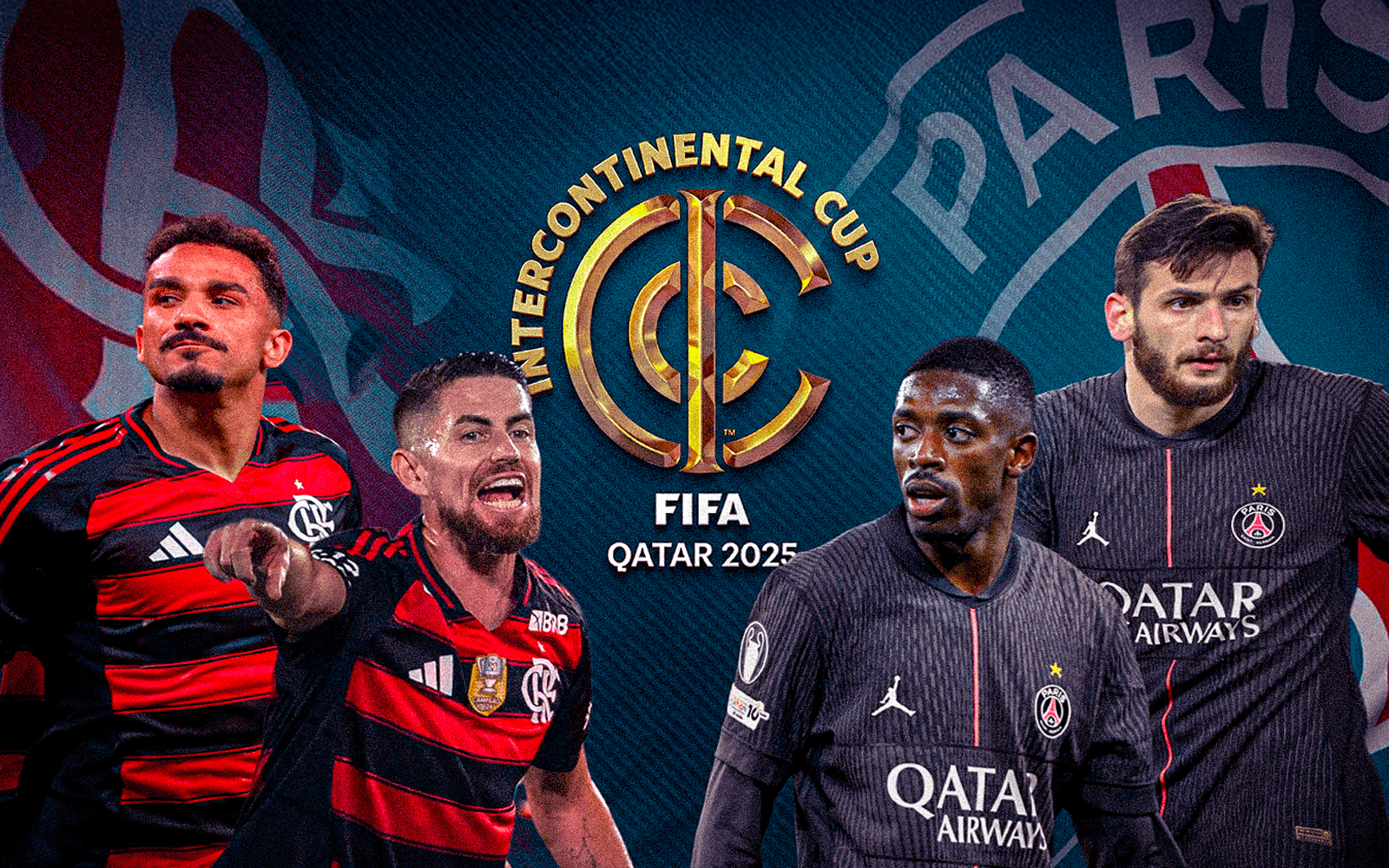

PSG vs Flamengo Intercontinental Cup Final Preview & Betting Tips

Best Crypto Betting Platforms in India | USDT & BTC Sportsbooks

Wanna Stay on top of the Game? Join our free Newsletter

Australian Open 2026 Preview: Record Prize Money and Historic Stakes in Melbourne

Best Christmas Slots 2025 | Festive Casino Games on tether.bet

Jake Paul vs Anthony Joshua Preview: Spectacle, Money and a Heavyweight Clash

PSG vs Flamengo Intercontinental Cup Final Preview & Betting Tips

Best Crypto Betting Platforms in India | USDT & BTC Sportsbooks

More Articles

Casino

2025-07-21

Discover the best Hacksaw Gaming slots with top features and big win potential. Play the most popular titles and explore unique slot mechanics.

Sports

2025-08-26

EuroBasket 2025 tips off! Explore groups, key players, tournament format and betting odds with tether.bet’s exclusive Free Bet promo.

Crypto

2025-09-11

Looking for the safest and smartest way to bet? Here are the top 5 reasons punters use Tether (USDT) for sports betting: stability, speed, low fees, worldwide access, and full security.

Wanna Stay on top of the Game? Join our free Newsletter

Info

Help

Responsable Gambling

© 2024 tether.bet | All rights reserved.